hi...

today i explain you " how to update a vat return online" for andhrapradesh vat dealers online

from july there are so many changes in our andhra pradesh commercial taxes website.

so there is some bit difficulty in submitting the vat return.

here is the few simple steps that explain you how to :

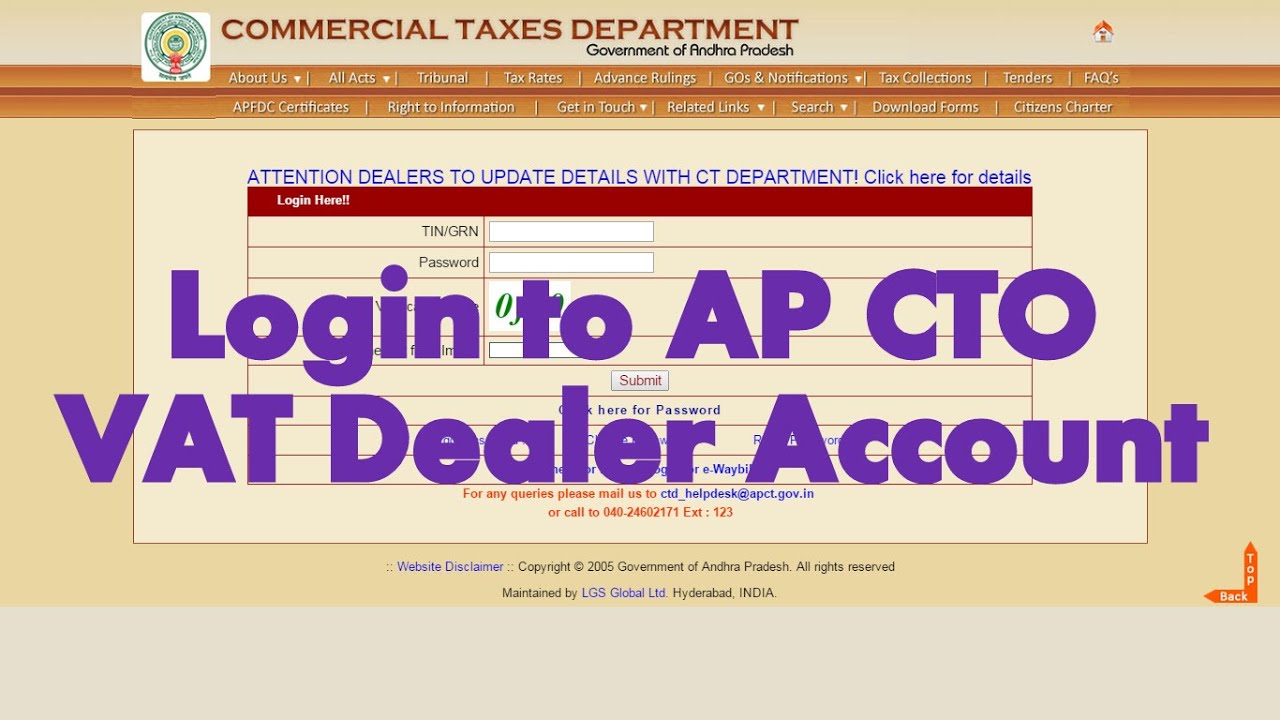

step 1 ; log in to the site with the "TIN NUMBER" or "GRN" which you obtain with the RC or registration certificate. and make sure you know the password , if the password is entered wrong for five time then you would be blocked for 24 hrs.

step 2 : download the ap vat purchase details template from here and make sure that you enter only the bills purchased from the ap vat dealers, this template is used to claim the input .and download the sales template from here and enter the details of the sales done for the

step 2 : download the ap vat purchase details template from here and make sure that you enter only the bills purchased from the ap vat dealers, this template is used to claim the input .and download the sales template from here and enter the details of the sales done for the

ap vat dealers only. after uploading the templates make sure any mismatches are made

and rectify it

step 3 : submitting vat 200A: this is the main part of the vat return here you must submit the total taxable amount , and exempted sales amount after submitting that you will be shown a new column for input tax paid: here enter the 5% input or 14.5% input amount you received by purchasing with in state and enter the amount. after submitting the vat 200A you will be prompted to submit vat200.

from 1st december 2015 the format of VAT 200 has added some new columns...

before entering the data please ensure that under which column you are entering the data

coz your smal mistake lead to heavy tax burden.

thank you

today i explain you " how to update a vat return online" for andhrapradesh vat dealers online

from july there are so many changes in our andhra pradesh commercial taxes website.

so there is some bit difficulty in submitting the vat return.

here is the few simple steps that explain you how to :

step 1 ; log in to the site with the "TIN NUMBER" or "GRN" which you obtain with the RC or registration certificate. and make sure you know the password , if the password is entered wrong for five time then you would be blocked for 24 hrs.

ap vat dealers only. after uploading the templates make sure any mismatches are made

and rectify it

step 3 : submitting vat 200A: this is the main part of the vat return here you must submit the total taxable amount , and exempted sales amount after submitting that you will be shown a new column for input tax paid: here enter the 5% input or 14.5% input amount you received by purchasing with in state and enter the amount. after submitting the vat 200A you will be prompted to submit vat200.

from 1st december 2015 the format of VAT 200 has added some new columns...

before entering the data please ensure that under which column you are entering the data

coz your smal mistake lead to heavy tax burden.

thank you