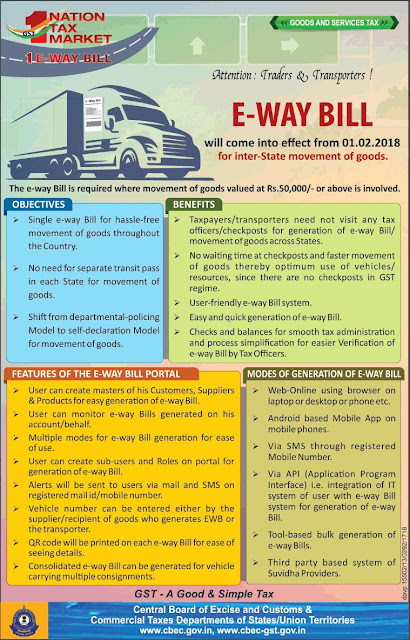

A nationwide E-way Bill System will be rolled out on trial basis from tomorrow i.e. 16th January, 2018. Avail the opportunity to get used to the system before it becomes compulsory.

SEMINAR ON GST ( GOODS AND SERVICE TAX) - SEMINAR BY V.G.RAVICHANDRA(CA),SEMINAR AT APSPDCL

SEMINAR BY

ASSISTANT COMMERCIAL TAX OFFICER (ACTO)

V.G.RAVICHANDRA (C.A)

ON

GST (GOODS AND SERVICE TAX) ACT

AT

APSPDCL

(ANDHRA PRADESH SOUTHERN POWER DISTRIBUTION CORPORATION LIMITED)

ASSISTANT COMMERCIAL TAX OFFICER (ACTO)

V.G.RAVICHANDRA (C.A)

ON

GST (GOODS AND SERVICE TAX) ACT

AT

APSPDCL

(ANDHRA PRADESH SOUTHERN POWER DISTRIBUTION CORPORATION LIMITED)

how to register for GST in INDIA , GOODS AND SERVICE TAX in INDIA

How to Register for Goods and Service Tax in india:

After a long discussions by our INDIAN government

our government has declared to amend the current state sales tax and central service tax

in to a single Act called GOODS AND SERVICE TAX

every one who is engaged in trading and service providing sector needs to be get

registered to GOODS AND SERVICE TAX through online

step 1: Access the Goods and Service Tax site http://gst.gov.in or click here

follow the instructions

every state got alloted a date and every dealer needs to register in the particular scheduled period itself.

Below table shows the dates alloted for GOODS AND SERVICE TAX registration

| States | Start Date | End Date |

|---|---|---|

| Puducherry, Sikkim | 08/11/2016 | 23/11/2016 |

| Maharashtra, Goa, Daman and Diu, Dadra and Nagar Haveli, Chhattisgarh | 14/11/2016 | 30/11/2016 |

| Gujarat | 15/11/2016 | 30/11/2016 |

| Odisha, Jharkhand, Bihar, West Bengal, Madhya Pradesh, Assam, Tripura, Meghalaya, Nagaland, Arunachal Pradesh, Manipur, Mizoram | 30/11/2016 | 15/12/2016 |

| Uttar Pradesh, Jammu and Kashmir, Delhi, Chandigarh, Haryana, Punjab, Uttarakhand, Himachal Pradesh, Rajasthan | 16/12/2016 | 31/12/2016 |

| Kerala, Tamil Nadu, Karnataka, Telangana, Andhra Pradesh | 01/01/2017 | 15/01/2017 |

| Enrolment of Taxpayers who are registered under Central Excise Act/ Service Tax Act but not registered under State VAT | 01/01/2017 | 31/01/2017 |

| Delta All Registrants (All Groups) | 01/02/2017 | 20/03/2017 |

income tax slab for ay 17-18

INCOME TAX SLABS FOR AY 17-18 IN INDIA

Income tax slab for 16-17 is same as previous year 15-17

Income tax slab for 16-17 is same as previous year 15-17

Income tax slab rate is different for a different class of taxpayers.

- Individual/HUF

- Senior Citizen

- Super Senior citizen

- Cooperative society

- Firm

- Local Authority

- Domestic Company

- Other Than Domestic Company

the most common income tax slabs for the past few years is as same as the current year 2016-17

Income Tax Slab for 2016 – 17

| Tax Rate | ||

| Taxable income is less than Rs. 2,50,000 | |||

| Taxable income is more than Rs. 2,50,000 but less than Rs. 5,00,000 | 10% of the amount above and over 2,50,000. | ||

| Taxable income is more than Rs. 5,00,000 but less than Rs. 10,00,000 | Rs. 25,000 + 20% of the amount by which the taxable income exceeds Rs. 5,00,000 | ||

| Taxable income is more than Rs. 10,00,000 | Rs. 1,25,000 + 30% of the amount by which the taxable income exceeds Rs. 10,00,000 | ||

partnership firm registration step by step procedure in AP

how to register a firm in AP

partnership registration in Andhra Pradesh(A.P).

firm registration in Andhra Pradesh.

Registration under Partnership Act 1932

to share profits there is a agreement called partner ship agreement

to legalize the agreement there is a procedure called firm registration...

here i am gonna explain you how to register a firm/ partnership firm

step one : fill the form available to register a firm

to register a new partnership firm we need to fill "form 1"

and relavant documents

which are available in the sub registrar's officail site.

AP sub registrars official website

step two : all the proofs like voter card/aadhar card/driving license/passport

of all the partners and self attested it, along with the required documents

like rental agreement , electricity bill, mainly PARTNER SHIP DEED

where all the above documents need to be submitted a copy

step three: all these documents are scanned for the sub registrats department

where the facility is available at any eseva/me-eseva centers

where firm registration scanning option is available.

and firm registration certificate will be issued to u as soon as possible when the

sub-registrar department accepts your application.

partnership registration in Andhra Pradesh(A.P).

firm registration in Andhra Pradesh.

Registration under Partnership Act 1932

to share profits there is a agreement called partner ship agreement

to legalize the agreement there is a procedure called firm registration...

here i am gonna explain you how to register a firm/ partnership firm

step one : fill the form available to register a firm

to register a new partnership firm we need to fill "form 1"

and relavant documents

which are available in the sub registrar's officail site.

AP sub registrars official website

step two : all the proofs like voter card/aadhar card/driving license/passport

of all the partners and self attested it, along with the required documents

like rental agreement , electricity bill, mainly PARTNER SHIP DEED

where all the above documents need to be submitted a copy

step three: all these documents are scanned for the sub registrats department

where the facility is available at any eseva/me-eseva centers

where firm registration scanning option is available.

and firm registration certificate will be issued to u as soon as possible when the

sub-registrar department accepts your application.

income tax slab for individuals/citizens for the financial year 2015-2016 in india

income tax slab rates for the individuals / citizens /senior citizens in India for the financial year 2015-2016

here the below box shows you the clear chart for the income tax department slabs realed in india for the financial 2015-2016 or assessment year 2016-2017

Citizens/Individual resident aged up to 59 years old

Income Tax :

| Income Slabs | Tax Rates | |

|---|---|---|

| i. | Where the taxable income does not exceed Rs. 2,50,000/-. | NIL |

| ii. | Where the taxable income exceeds Rs. 2,50,000/- but does not exceed Rs. 5,00,000/-. | 10% of amount by which the taxable income exceeds Rs. 2,50,000/-. Less : Tax Credit u/s 87A - 10% of taxable income upto a maximum of Rs. 2000/-. |

| iii. | Where the taxable income exceeds Rs. 5,00,000/- but does not exceed Rs. 10,00,000/-. | Rs. 25,000/- + 20% of the amount by which the taxable income exceeds Rs. 5,00,000/-. |

| iv. | Where the taxable income exceeds Rs. 10,00,000/-. | Rs. 125,000/- + 30% of the amount by which the taxable income exceeds Rs. 10,00,000/-. |

Surcharge : 12% of the Income Tax, where taxable income is more than Rs. 1 crore. (click here to check Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

senior citizen resident aged more than 60 years old and below 80 years

| Income Slabs | Tax Rates | |

|---|---|---|

| i. | Where the taxable income does not exceed Rs. 3,00,000/-. | NIL |

| ii. | Where the taxable income exceeds Rs. 3,00,000/- but does not exceed Rs. 5,00,000/- Less : Tax Credit u/s 87A - 10% of taxable income upto a maximum of Rs. 2000/- | 10% of the amount by which the taxable income exceeds Rs. 3,00,000/-. Less : Tax Credit u/s 87A - 10% of taxable income upto a maximum of Rs. 2000/-. |

| iii. | Where the taxable income exceeds Rs. 5,00,000/- but does not exceed Rs. 10,00,000/- | Rs. 20,000/- + 20% of the amount by which the taxable income exceeds Rs. 5,00,000/-. |

| iv. | Where the taxable income exceeds Rs. 10,00,000/- | Rs. 120,000/- + 30% of the amount by which the taxable income exceeds Rs. 10,00,000/-. |

Surcharge : 12% of the Income Tax, where taxable income is more than Rs. 1 crore.

Education Cess : 3% of the total of Income Tax and Surcharge.

Individual resident aged more than 80 years paying INCOME TAX will not be healthy and will be died soon...

so no need to check this option...

thank you for visiting

please review us with your valuable comments and suggestions

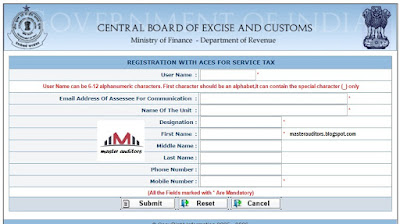

how to get service tax registration user id online in India

how to get service tax registration User Id in India

step by step procedure to obtain service tax registration USER Id in India.

tep 1 .

go to service tax site where you can easily find out it in google.

if you are unable to to find the link of service tax department you can click on the link at our side bar which is available to you correctly left side top of our blog or you may click here too

a page will appear as shown in the image

Step 2 .

click on the click here option available behind the login form.

you will be redirected to a page as shown in the second image..

you will be redirected to a page as shown in the second image..

this is the main part to get the login credentials for a registration..

enter the correct details in the required text box

as "username"

"email id"

etc.,etc.,

email id should be correct because the login credentials are sent you via this email itself

by clicking on the submit button you are successfully finished the process of online user id registration for Service tax

and here starts the main process to obtain the service tax registration

step by step procedure to obtain service tax registration USER Id in India.

tep 1 .

go to service tax site where you can easily find out it in google.

if you are unable to to find the link of service tax department you can click on the link at our side bar which is available to you correctly left side top of our blog or you may click here too

a page will appear as shown in the image

Step 2 .

click on the click here option available behind the login form.

you will be redirected to a page as shown in the second image..

you will be redirected to a page as shown in the second image..this is the main part to get the login credentials for a registration..

enter the correct details in the required text box

as "username"

"email id"

etc.,etc.,

email id should be correct because the login credentials are sent you via this email itself

by clicking on the submit button you are successfully finished the process of online user id registration for Service tax

and here starts the main process to obtain the service tax registration

types of GST in India

they are

1. CGST - Central Goods And Service Tax

2. SGST - State Goods And Service Tax

3. IGST - Integrated Goods And Service Tax

actually here as said above both CGST & SGST will be subsumed in a single tax

Goods and Service Tax digest

Subscribe to:

Comments

(

Atom

)